how to make money fast

How to Make Money Fast

Are you in a financial bind and need to find a way to make money fast? Whether you're facing an unexpected expense or simply looking to boost your income, there are several strategies you can employ to generate cash quickly. In this article, we'll explore some effective methods to help you make money fast.

1. Sell Unwanted Items

One of the quickest ways to make money is by selling items you no longer need or want. Start by decluttering your home and identifying items that are in good condition but no longer serve a purpose for you. You can sell these items online through platforms like eBay, Facebook Marketplace, or Craigslist. Alternatively, you can hold a garage sale or sell items to local thrift stores.

2. Offer Your Services

Consider what skills or talents you possess that others might be willing to pay for. Whether you're a skilled graphic designer, a knowledgeable tutor, or an expert in a particular field, there are opportunities to offer your services on a freelance basis. Websites like Upwork, Fiverr, and Freelancer allow you to connect with clients looking for your expertise.

3. Perform Gigs

There are numerous gig economy platforms that enable you to earn money quickly by completing short-term tasks. Examples include TaskRabbit, Uber, and DoorDash. These platforms offer a variety of gig opportunities, from delivering food to running errands, cleaning houses, or even dog walking.

4. Start a Side Business

Consider starting a small side business that can generate income while you continue with your regular job. Ideas for side businesses include selling handmade crafts, starting a blog, or offering consulting services in your field of expertise. By leveraging your existing skills and interests, you can create a profitable side hustle.

5. Invest in High-Yield Savings Accounts

While this method may not provide immediate cash, investing in high-yield savings accounts can help you make money over time. Look for accounts that offer higher interest rates than traditional savings accounts. By parking your money in these accounts, you can earn a modest return on your savings.

6. Participate in Surveys and Focus Groups

Many companies are willing to pay for your opinions. Participating in online surveys, focus groups, and product testing can be a quick way to make some extra cash. Websites like Swagbucks, Survey Junkie, and Pinecone Research offer opportunities to earn money by sharing your thoughts and experiences.

7. Rent Out Your Space

If you have extra space in your home, consider renting it out on platforms like Airbnb. This can be a lucrative way to make money, especially if you live in a popular tourist destination or in a high-demand area. Just be sure to follow all legal requirements and ensure your space is safe and welcoming for guests.

In conclusion, there are several ways to make money fast, depending on your skills, resources, and available time. By exploring these options, you can find a strategy that works for you and help alleviate your financial needs. Remember to prioritize safety and legality when pursuing any money-making endeavor.

how to make money online

Making money online has become an increasingly popular way to earn a living in today's digital age. With the rise of the internet, there are countless opportunities to make money from the comfort of your own home. Whether you're looking to supplement your income or start a full-time online business, here are some tips on how to make money online.

Choose a Niche

The first step in making money online is to choose a niche. A niche is a specific area of interest or expertise. By focusing on a niche, you can attract a targeted audience and build a loyal following. Some popular niches include fitness, fashion, travel, and technology. Research different niches and find one that you are passionate about and have knowledge in.

Once you have chosen a niche, the next step is to create content. Content can be in the form of blog posts, videos, podcasts, or social media posts. The key is to provide valuable and informative content that your audience will find useful. This will help you establish yourself as an authority in your niche and build trust with your audience.

Monetize Your Content

Once you have created content, the next step is to monetize it. There are several ways to monetize your online content, including: - Advertising: You can earn money by displaying ads on your website or social media channels. Platforms like Google AdSense and Media.net allow you to do this. - Affiliate marketing: This involves promoting products or services and earning a commission for each sale or referral. Websites like Amazon Associates and ClickBank offer affiliate marketing opportunities. - Selling products: You can sell your own products or services, such as e-books, courses, or consulting services. Platforms like Etsy and Shopify make it easy to sell products online. - Freelancing: If you have a specific skill set, such as writing, graphic design, or web development, you can offer your services on platforms like Upwork and Fiverr.

It's important to note that monetizing your content takes time and effort. You may not see immediate results, but with persistence and dedication, you can build a profitable online business.

Build a Social Media Presence

Social media is a powerful tool for building an audience and driving traffic to your content. Platforms like Facebook, Instagram, Twitter, and LinkedIn can help you reach a wider audience and engage with your followers. Here are some tips for building a social media presence: - Consistency: Post regularly and consistently to keep your audience engaged. - Engagement: Respond to comments and messages to build a community around your brand. - Visuals: Use high-quality images and videos to make your content more visually appealing. - Hashtags: Use relevant hashtags to increase the visibility of your posts.

By building a strong social media presence, you can drive traffic to your content and increase your chances of making money online.

Join Online Communities

Joining online communities can help you connect with like-minded individuals and learn from their experiences. Platforms like Reddit, Quora, and LinkedIn Groups offer opportunities to network and share your expertise. By participating in these communities, you can gain valuable insights and build relationships that can lead to new business opportunities.

In conclusion, making money online requires dedication, persistence, and a willingness to learn. By choosing a niche, creating valuable content, monetizing your content, building a social media presence, and joining online communities, you can increase your chances of success. Remember that success takes time, so be patient and stay focused on your goals.

how to make money

How to Make Money: Strategies for Financial Success In today's fast-paced world, making money is a top priority for many individuals. Whether you're looking to boost your income, start a new business, or simply find ways to make extra cash, there are numerous strategies you can employ. In this article, we will explore various methods to help you achieve financial success.

Invest in Yourself

The first step to making money is to invest in yourself. This means acquiring new skills, knowledge, and experiences that can help you excel in your career or business. Consider the following:

1. Education: Pursue higher education or attend workshops and seminars to expand your knowledge base.

2. Networking: Build a strong professional network by attending industry events and connecting with like-minded individuals.

3. Personal development: Read books, listen to podcasts, and engage in activities that help you grow as a person.

Start a Side Business

A side business can be a great way to make extra money while maintaining your day job. Here are some ideas to consider:

1. Freelancing: Offer your skills and expertise to clients on platforms like Upwork or Fiverr.

2. Online store: Create an online store on platforms like Etsy or eBay to sell products you're passionate about.

3. Tutoring: Share your knowledge with others by offering tutoring services in your area of expertise.

Invest in the Stock Market

Investing in the stock market can be a lucrative way to make money, but it's important to do your research and understand the risks involved. Here are some tips for getting started:

1. Educate yourself: Learn about different investment strategies, such as dividend investing, value investing, and growth investing.

2. Start small: Begin with a small amount of money and gradually increase your investments as you become more comfortable.

3. Diversify: Don't put all your money into one stock or sector; instead, diversify your investments to minimize risk.

Save and Budget

One of the most effective ways to make money is to save and budget wisely. Here are some tips to help you get started:

1. Create a budget: Track your income and expenses to identify areas where you can cut back.

2. Save regularly: Set aside a portion of your income for savings, and consider opening a high-interest savings account.

3. Avoid debt: Minimize your debt by paying off high-interest loans and credit card balances.

Utilize Technology

Technology has made it easier than ever to make money. Here are some ways to leverage technology:

1. Online marketing: Use social media, email marketing, and content marketing to promote your business or products.

2. Mobile apps: Develop or monetize a mobile app that provides value to users.

3. Remote work: Offer your services remotely to clients worldwide and save on commuting and office expenses.

In conclusion, making money requires a combination of education, creativity, and discipline. By investing in yourself, starting a side business, investing in the stock market, saving and budgeting, and utilizing technology, you can achieve financial success. Remember that patience and persistence are key to long-term success.

earn money online from home

In today's digital age, the concept of earning money from home has become increasingly popular. With the rise of the internet and remote work opportunities, more and more individuals are looking for ways to supplement their income or even replace their traditional jobs. Here are some effective methods to earn money online from home.

Online Freelancing

One of the most common ways to earn money online is through freelancing. Websites like Upwork, Freelancer, and Fiverr offer a platform for individuals to showcase their skills and offer their services to clients worldwide. Whether you are a writer, graphic designer, programmer, or translator, there is a market for your skills. To succeed in online freelancing, it's important to create a professional profile, set competitive prices, and deliver high-quality work.

Online freelancing allows you to work on your own schedule, which can be particularly beneficial if you have other commitments. However, it's crucial to manage your time effectively and set aside dedicated hours for work to ensure productivity and meet client deadlines.

Online Surveys and Market Research

Another way to earn money from home is by participating in online surveys and market research studies. Many companies are willing to pay for consumer opinions and insights. Websites like Swagbucks, Survey Junkie, and Vindale Research offer opportunities to earn money by completing surveys and providing feedback on products and services.

While the income from online surveys may not be substantial, it can be a good way to earn some extra cash in your spare time. It's important to be cautious and only sign up for reputable survey sites to avoid scams.

Online Teaching and Tutoring

If you have expertise in a particular subject or language, online teaching and tutoring can be a lucrative option. Platforms like VIPKid, Preply, and Chegg Tutors allow you to teach students from around the world. You can set your own rates and choose the subjects and students you want to work with.

Online teaching requires good communication skills and the ability to adapt to different learning styles. It's also important to have a quiet and well-lit workspace to ensure a productive learning environment for your students.

Creating and Selling Digital Products

If you have a passion for creating content, you can earn money online by selling digital products. This can include e-books, courses, stock photography, or even digital art. Websites like Etsy, Gumroad, and Teachable provide platforms for you to sell your creations directly to customers.

Creating digital products requires time and effort to develop high-quality content. However, once created, these products can generate passive income over time as they are sold repeatedly.

Online Business Opportunities

Starting an online business can be a significant step towards earning money from home. This could involve selling products on marketplaces like Amazon or eBay, creating a blog or YouTube channel, or even starting a dropshipping business. The key to success in online business is to identify a niche market and provide value to your customers.

Online businesses require initial investment and dedication, but they can offer the potential for substantial income over time. It's important to do thorough market research and create a solid business plan before diving in.

In conclusion, earning money online from home is not only possible but also offers a variety of opportunities. Whether you choose to freelance, participate in surveys, teach online, sell digital products, or start an online business, it's important to stay committed, persistent, and always look for ways to improve your skills and services. With the right approach, you can create a sustainable income stream that allows you to work from the comfort of your home.

how to earn money for online

How to Earn Money for Online In today's digital age, earning money online has become increasingly popular and accessible. With the rise of the internet, countless opportunities have emerged for individuals to make a living from the comfort of their own homes. Whether you are looking to supplement your income or start a full-time online business, here are some effective ways to earn money online.

Freelancing

Freelancing is a versatile option that allows you to work on projects based on your skills and expertise. Websites like Upwork, Freelancer, and Fiverr provide a platform for freelancers to connect with clients from all over the world. You can offer services such as writing, graphic design, web development, programming, and more. The key to success in freelancing is to build a strong portfolio and establish a good reputation.

1. Identify your skills: Assess your skills and choose a niche that you are passionate about. This will help you attract clients who are looking for your specific expertise.

2. Create a portfolio: Showcase your best work in a portfolio that you can share with potential clients. This will help you stand out and demonstrate your abilities.

3. Network: Join online communities and forums related to your field. Engage with other professionals and potential clients to build your network.

4. Set competitive rates: Research the market rates for your services and set competitive prices that reflect your skills and experience.

Online Surveys and Market Research

Taking online surveys and participating in market research studies can be a lucrative way to earn money. Many companies are willing to pay individuals for their opinions and insights. Websites like Swagbucks, Survey Junkie, and InboxDollars offer opportunities to earn money by completing surveys, watching videos, and trying out products.

1. Sign up for multiple survey sites: Join several survey platforms to increase your chances of earning more money.

2. Be honest: Provide accurate and honest responses to survey questions. Companies value genuine opinions.

3. Keep track of your earnings: Monitor your earnings and cash out when you reach the minimum payout threshold.

Online Courses and E-books

If you have expertise in a particular subject, you can create online courses or write e-books to share your knowledge with others. Platforms like Udemy, Teachable, and Amazon Kindle Direct Publishing allow you to sell your courses and e-books to a global audience.

1. Identify your target audience: Determine who will benefit from your course or e-book and tailor your content to their needs.

2. Create high-quality content: Invest in professional video equipment and editing software to produce high-quality courses or e-books.

3. Market your products: Utilize social media, email marketing, and other promotional strategies to attract students or readers.

Affiliate Marketing

Affiliate marketing involves promoting products or services on your website, blog, or social media channels and earning a commission for each sale or referral. Websites like Amazon Associates, ClickBank, and ShareASale offer a wide range of affiliate programs to choose from.

1. Choose the right products: Select products that align with your niche and target audience.

2. Create engaging content: Develop high-quality content that promotes the products and encourages readers to make purchases.

3. Track your performance: Monitor your affiliate links and analyze the data to optimize your marketing strategies.

In conclusion, earning money online requires dedication, perseverance, and a willingness to learn. By exploring various opportunities such as freelancing, online surveys, courses, and affiliate marketing, you can find a way to generate income that suits your skills and interests. Remember to stay focused, be patient, and continuously improve your skills to maximize your earnings.

how earn money in online

【How Earn Money in Online】 In the digital age, earning money online has become a more accessible and flexible option for many people. With the rise of the internet, a myriad of opportunities has emerged, allowing individuals to make a living from the comfort of their homes. Whether you are looking to supplement your income or pursue a full-time online career, there are numerous ways to earn money in the online realm. This article will explore some of the most popular methods of making money online.

Freelancing

Freelancing is one of the most popular ways to earn money online. As a freelancer, you can offer your skills and expertise in various fields, such as writing, graphic design, web development, and virtual assistance. Platforms like Upwork, Freelancer, and Fiverr provide a platform for freelancers to connect with clients from all over the world. To succeed in freelancing, it is essential to build a strong portfolio, establish good communication skills, and deliver high-quality work.

Another popular freelancing niche is content creation. Platforms like YouTube, TikTok, and Instagram offer content creators the opportunity to make money through advertising revenue, sponsorships, and affiliate marketing. To be successful in this field, you need to create engaging and shareable content, build a loyal following, and develop a unique brand identity.

Online Marketing

Online marketing is a versatile way to earn money, with various strategies to choose from. Affiliate marketing is one of the most popular online marketing methods, where you earn a commission for promoting other people's products. To succeed in affiliate marketing, you need to find a niche, create valuable content, and drive traffic to your website or social media pages.

Another popular online marketing method is dropshipping, where you sell products online without physically holding inventory. This model allows you to focus on marketing and customer service while outsourcing the logistics to third-party suppliers. To make money through dropshipping, you need to find profitable products, optimize your online store, and build a strong customer base.

Online Surveys and Market Research

Participating in online surveys and market research can be an easy way to earn money in your spare time. Websites like Swagbucks, Survey Junkie, and InboxDollars offer paid surveys, product testing, and other opportunities to make money. While the pay for these tasks may not be substantial, they can be a good way to supplement your income or earn a little extra cash.

Online teaching is another way to make money from home, especially if you have expertise in a particular subject. Platforms like VIPKid, iTutorGroup, and Preply allow you to teach students from around the world through live video calls. To succeed in online teaching, you need to be patient, well-organized, and possess strong communication skills.

Passive Income

Passive income refers to earnings that require minimal effort to maintain. Some popular sources of passive income include creating and selling digital products, such as e-books or courses, and investing in stocks or real estate. While these methods can be lucrative, they often require an initial investment of time and money and may not be suitable for everyone. In conclusion, earning money online has become an increasingly viable option for many individuals. With a wide range of opportunities available, from freelancing and online marketing to online teaching and passive income, there is something for everyone. Whether you are looking to supplement your income or pursue a full-time online career, it is essential to research, plan, and stay committed to your goals.

earn money online free

How Can I Earn Money Online? In today's digital age, the internet has opened up countless opportunities for individuals to earn money from the comfort of their own homes. Whether you're looking to supplement your income or start a full-time online business, there are numerous ways to make money online. Here are some strategies and platforms you can explore to get started.

Freelancing

Freelancing is a popular way to earn money online. Platforms like Upwork, Freelancer, and Fiverr connect freelancers with clients seeking various services, such as writing, graphic design, programming, and virtual assistance. To succeed in freelancing, you'll need to create a compelling profile, showcase your skills, and bid on relevant projects. Remember to set clear communication with clients and deliver high-quality work to build a good reputation.

Some tips for freelancing success include:

-

Specialize in a niche area where you have expertise.

-

Build a strong portfolio to demonstrate your skills.

-

Be responsive and professional in your communication.

-

Set realistic deadlines and deliver on time.

Online Surveys and Market Research

Participating in online surveys and market research can be a simple way to earn money. Websites like Swagbucks, Survey Junkie, and Vindale Research offer opportunities to earn cash, gift cards, or rewards points by completing surveys and participating in research studies. While the pay per survey may not be substantial, it can add up over time, especially if you dedicate a significant amount of time to it.

Here are some things to keep in mind when doing online surveys:

-

Be cautious of scams and only sign up with reputable sites.

-

Read the terms and conditions carefully to understand the payment structure.

-

Be honest in your responses to increase your chances of being selected for more surveys.

Online Courses and E-Learning

If you have a passion for a particular subject or skill, creating and selling online courses can be a lucrative venture. Platforms like Udemy, Teachable, and Thinkific allow you to create and sell courses on virtually any topic. You can choose to teach in video format, with text-based content, or a combination of both. The key to success in online course creation is to provide valuable content and engage your students.

Here are some steps to creating a successful online course:

-

Identify a topic you are knowledgeable about and passionate about.

-

Research the market to ensure there is demand for your course.

-

Develop high-quality content that is engaging and informative.

-

Market your course effectively to attract students.

Selling Products Online

Selling products online has become increasingly popular with platforms like Etsy, eBay, and Amazon. You can sell handmade crafts, vintage items, or even new products. To succeed in online selling, you'll need to create an attractive product listing, take high-quality photos, and understand the logistics of shipping and handling.

Here are some tips for online selling:

-

Choose a niche market that you are passionate about.

-

Research the competition to price your products competitively.

-

Invest in good quality product photos to attract buyers.

-

Be responsive to customer inquiries and provide excellent customer service.

Content Creation

If you have a knack for writing, photography, or video production, content creation can be a rewarding way to earn money online. You can start a blog, create a YouTube channel, or become a social media influencer. Monetization can come from advertising, sponsorships, affiliate marketing, and selling your own products or services.

Here are some tips for content creation success:

-

Choose a niche that you are passionate about and that has a target audience.

-

Consistently produce high-quality content to build a loyal following.

-

Utilize SEO strategies to increase your visibility online.

-

Network with other creators to expand your reach.

By exploring these various methods, you can find the right online income opportunity that suits your skills, interests, and lifestyle. Remember that success often requires patience, persistence, and a willingness to learn and adapt. With the right approach, earning money online can be a fulfilling and profitable endeavor.

how can i earn money online

How Can I Earn Money Online? In today's digital age, the internet has opened up countless opportunities for individuals to earn money from the comfort of their own homes. Whether you're looking to supplement your income or start a full-time online business, there are numerous ways to make money online. Here are some strategies and platforms you can explore to get started.

Freelancing

Freelancing is a popular way to earn money online. Platforms like Upwork, Freelancer, and Fiverr connect freelancers with clients seeking various services, such as writing, graphic design, programming, and virtual assistance. To succeed in freelancing, you'll need to create a compelling profile, showcase your skills, and bid on relevant projects. Remember to set clear communication with clients and deliver high-quality work to build a good reputation.

Some tips for freelancing success include:

-

Specialize in a niche area where you have expertise.

-

Build a strong portfolio to demonstrate your skills.

-

Be responsive and professional in your communication.

-

Set realistic deadlines and deliver on time.

Online Surveys and Market Research

Participating in online surveys and market research can be a simple way to earn money. Websites like Swagbucks, Survey Junkie, and Vindale Research offer opportunities to earn cash, gift cards, or rewards points by completing surveys and participating in research studies. While the pay per survey may not be substantial, it can add up over time, especially if you dedicate a significant amount of time to it.

Here are some things to keep in mind when doing online surveys:

-

Be cautious of scams and only sign up with reputable sites.

-

Read the terms and conditions carefully to understand the payment structure.

-

Be honest in your responses to increase your chances of being selected for more surveys.

Online Courses and E-Learning

If you have a passion for a particular subject or skill, creating and selling online courses can be a lucrative venture. Platforms like Udemy, Teachable, and Thinkific allow you to create and sell courses on virtually any topic. You can choose to teach in video format, with text-based content, or a combination of both. The key to success in online course creation is to provide valuable content and engage your students.

Here are some steps to creating a successful online course:

-

Identify a topic you are knowledgeable about and passionate about.

-

Research the market to ensure there is demand for your course.

-

Develop high-quality content that is engaging and informative.

-

Market your course effectively to attract students.

Selling Products Online

Selling products online has become increasingly popular with platforms like Etsy, eBay, and Amazon. You can sell handmade crafts, vintage items, or even new products. To succeed in online selling, you'll need to create an attractive product listing, take high-quality photos, and understand the logistics of shipping and handling.

Here are some tips for online selling:

-

Choose a niche market that you are passionate about.

-

Research the competition to price your products competitively.

-

Invest in good quality product photos to attract buyers.

-

Be responsive to customer inquiries and provide excellent customer service.

Content Creation

If you have a knack for writing, photography, or video production, content creation can be a rewarding way to earn money online. You can start a blog, create a YouTube channel, or become a social media influencer. Monetization can come from advertising, sponsorships, affiliate marketing, and selling your own products or services.

Here are some tips for content creation success:

-

Choose a niche that you are passionate about and that has a target audience.

-

Consistently produce high-quality content to build a loyal following.

-

Utilize SEO strategies to increase your visibility online.

-

Network with other creators to expand your reach.

By exploring these various methods, you can find the right online income opportunity that suits your skills, interests, and lifestyle. Remember that success often requires patience, persistence, and a willingness to learn and adapt. With the right approach, earning money online can be a fulfilling and profitable endeavor.

earn with online

Introduction

In today's digital age, the internet has become an indispensable tool for connecting people from all over the world. It has opened up numerous opportunities for individuals to earn a living from the comfort of their own homes. One such opportunity is earning with online platforms. This article explores various ways in which individuals can generate income through the internet.

【earn with online】 has become a popular trend among young professionals, students, and housewives alike. With the increasing number of online platforms and resources available, it is now easier than ever to make money from home. Let's delve into some of the most popular ways to earn with online.

Freelancing

Freelancing is one of the most common ways to earn with online. It involves offering your skills and expertise to clients on a project basis. Freelancers can find work on platforms such as Upwork, Freelancer, and Fiverr. Here are some popular freelancing jobs: - Writing and editing - Graphic design - Web development - Data entry - Virtual assistance

Freelancing offers flexibility and the opportunity to work on projects that interest you. However, it is essential to have a strong portfolio and excellent communication skills to attract clients.

Online Surveys and Market Research

Another way to earn with online is by participating in online surveys and market research studies. Many companies are willing to pay for your opinions and insights. Websites like Swagbucks, Survey Junkie, and InboxDollars offer opportunities to earn money by completing surveys and providing feedback.

While the earnings from online surveys may not be substantial, they can be a good way to earn some extra cash in your free time.

Online Teaching and Tutoring

If you have expertise in a particular subject, online teaching and tutoring can be a lucrative option. Websites like VIPKid, iTutorGroup, and Preply allow you to teach students from around the world. You can set your own schedule and earn money by sharing your knowledge.

Online teaching requires patience, creativity, and good communication skills. However, the flexibility and potential for high earnings make it a popular choice among many individuals.

E-commerce

E-commerce has seen a surge in popularity in recent years. You can earn with online by starting an online store or dropshipping business. Platforms like Shopify, WooCommerce, and Amazon offer tools and resources to help you get started.

When starting an e-commerce business, it is crucial to research the market and identify a niche that you are passionate about. Building a strong online presence and marketing your products effectively are key to success.

Conclusion

Earning with online has become a viable option for many individuals looking to supplement their income or start a new career. With the right skills, resources, and dedication, you can find numerous ways to make money from the comfort of your own home. Whether you choose freelancing, online surveys, teaching, or e-commerce, the key is to stay committed and adapt to the ever-changing online landscape.

online money earning methods

Online Money Earning Methods In today's digital age, the internet has opened up numerous opportunities for individuals to earn money from the comfort of their homes. With the rise of online platforms and digital technologies, there are various methods available for making money online. Here are some popular online money earning methods that you can consider.

Freelancing

Freelancing has become one of the most popular ways to earn money online. As a freelancer, you can offer your skills and expertise in various fields such as writing, graphic design, web development, and more. Platforms like Upwork, Freelancer, and Fiverr provide a platform for freelancers to connect with clients from all over the world. To succeed in freelancing, it is important to build a strong portfolio and establish good communication skills.

Freelancing offers flexibility and the opportunity to work on projects that interest you. However, it is essential to manage your time effectively and meet deadlines to maintain a good reputation and attract more clients.

Online Surveys and Market Research

Participating in online surveys and market research studies can be a simple and straightforward way to earn money. Many companies are willing to pay individuals for their opinions and insights. Websites like Swagbucks, Survey Junkie, and Vindale Research offer paid surveys that you can complete in your free time. While the earnings from these surveys may not be substantial, they can be a good way to supplement your income.

It is important to be cautious when signing up for online survey websites. Make sure to research the legitimacy of the site and read reviews from other users before sharing any personal information.

Dropshipping

Dropshipping is a retail method where you sell products online without physically holding inventory. Instead, when a customer purchases a product from your online store, it is purchased from a third-party supplier who then ships the product directly to the customer. This method requires minimal investment and can be started with just a website and an online marketplace like eBay or Amazon.

Dropshipping can be a profitable business model, but it requires careful research and selection of products to ensure high demand and good profit margins. Additionally, managing customer service and handling returns can be challenging.

Content Creation

If you have a passion for creating content, you can monetize your skills through platforms like YouTube, TikTok, or blogs. By creating engaging and valuable content, you can attract an audience and generate income through advertising, sponsorships, and affiliate marketing. It is important to consistently produce high-quality content and engage with your audience to build a loyal following.

Content creation can be a long-term and rewarding career, but it requires dedication and persistence. It may take time to build a significant following and start earning a substantial income.

Online Courses and E-books

If you have expertise in a particular subject, you can create online courses or e-books and sell them on platforms like Udemy, Teachable, or Amazon Kindle Direct Publishing. By sharing your knowledge and skills, you can earn money while helping others learn and grow.

Creating online courses or e-books requires time and effort to develop high-quality content. However, once created, they can generate passive income over time.

In conclusion, there are numerous online money earning methods available for individuals looking to make money from home. Whether you choose freelancing, online surveys, dropshipping, content creation, or creating online courses, it is important to research and choose a method that aligns with your skills and interests. With determination and hard work, you can successfully earn money online and achieve financial freedom.

best way to earn money online

【best way to earn money online】

In today's digital age, the internet has opened up countless opportunities for earning money online. With the right strategy and tools, anyone can find a way to make a profit from the comfort of their own home. However, with so many options available, it can be challenging to determine the best way to earn money online. In this article, we will explore some of the most effective methods for making money online and provide tips on how to choose the right path for you.

Freelancing

Freelancing is one of the most popular ways to earn money online. It allows you to work on projects that interest you and set your own schedule. Whether you have skills in writing, graphic design, programming, or another area, there are numerous websites where you can find clients. Websites like Upwork, Freelancer, and Fiverr connect freelancers with businesses in need of their services. To succeed in freelancing, it's important to build a strong portfolio and establish a good reputation.

Online Courses and Tutorials

If you have expertise in a particular subject, creating online courses or tutorials can be a lucrative way to earn money. Platforms like Udemy, Teachable, and Skillshare allow you to create and sell your courses to a global audience. You can choose to create courses on topics you are passionate about, and the best part is that you can continue to earn money from your courses even when you're not actively teaching. This method requires some initial investment in time and effort to create high-quality content, but the potential for passive income is significant.

Content Creation

Creating content for platforms like YouTube, Instagram, or blogs can be a great way to earn money online. By building a following and monetizing your content, you can generate revenue through ad revenue, sponsorships, and affiliate marketing. The key to success in content creation is to choose a niche that you are passionate about and consistently produce high-quality content. It's also important to engage with your audience and understand what they want to see.

E-commerce

E-commerce has seen a surge in popularity in recent years, and it's an excellent way to earn money online. You can start by selling products on marketplaces like eBay, Amazon, or Etsy. Alternatively, you can create your own online store using platforms like Shopify or WooCommerce. The key to success in e-commerce is to source products that have a high demand and offer competitive pricing. Additionally, effective marketing strategies can help drive traffic to your store and increase sales.

Online Surveys and Market Research

If you're looking for a more straightforward way to earn money online, participating in online surveys and market research can be a good option. Websites like Swagbucks, Survey Junkie, and Pinecone Research pay users for completing surveys and participating in studies. While the income from these activities is typically not substantial, they can be a good way to earn some extra cash in your spare time.

Choose the Right Path for You

When deciding on the best way to earn money online, it's essential to consider your skills, interests, and the time you can commit. Here are some tips to help you choose the right path: 1. **Assess Your Skills**: Identify what you are good at and how you can monetize those skills. 2. **Research**: Look into different methods and find out which ones align with your goals. 3. **Start Small**: Begin with a small project or experiment to test the waters before fully committing. 4. **Stay Persistent**: Earning money online can take time, so be patient and persistent. 5. **Learn from Mistakes**: Don't be afraid to make mistakes; learn from them and keep moving forward. Remember, the best way to earn money online is one that combines your skills, interests, and the potential for growth. With dedication and the right strategy, you can find a profitable way to make money online.

earn money online fast

Are you looking for ways to earn money online fast? Many people are searching for opportunities to make quick cash, whether it's to supplement their income or to achieve financial freedom. Here are some legitimate and effective methods to help you earn money online quickly.

1. Freelancing on Platforms like Upwork and Fiverr

Freelancing is a popular way to earn money online fast. Platforms like Upwork and Fiverr connect freelancers with clients who need various services, from writing and graphic design to programming and virtual assistance. Sign up, create a profile, and start bidding on projects that match your skills. You can earn money quickly by completing small tasks or larger projects, depending on your expertise.

2. Online Surveys and Market Research

Participating in online surveys and market research studies is a simple way to make money fast. Websites like Swagbucks, Survey Junkie, and Vindale Research offer paid surveys that you can complete in your spare time. While the pay per survey may not be high, it can add up over time, and it's a great way to earn some extra cash without any special skills.

3. Selling Products on Online Marketplaces

Platforms like eBay, Amazon, and Etsy allow you to sell products online. If you have items you no longer need or can source products at a low cost, selling them online can be a quick way to make money. You can also create and sell digital products like e-books, printables, or music on these platforms.

4. Affiliate Marketing

Affiliate marketing involves promoting products or services online and earning a commission for each sale or referral. You can start by creating a blog or social media account and sharing affiliate links. As you grow your audience, you can increase your earnings. Websites like Amazon Associates and ClickBank offer a wide range of products to promote.

5. Online Courses and Workshops

If you have a skill or knowledge that others would find valuable, consider creating and selling online courses or conducting workshops. Platforms like Udemy, Teachable, and Skillshare make it easy to create and sell courses on a variety of topics. You can set your own pricing and earn money as students enroll in your courses.

6. Dropshipping

Dropshipping is a retail method where you sell products online but don't keep them in stock. Instead, when you sell a product, it's purchased from a third party and shipped directly to the customer. This method requires minimal upfront investment and can be started with just a website and an online marketplace account.

7. Virtual Assistant Services

Becoming a virtual assistant can be a lucrative way to earn money online fast. Virtual assistants provide administrative, technical, or creative assistance to clients remotely. You can offer services such as email management, scheduling, and social media management. Websites like Belay and Zirtual connect virtual assistants with clients.

8. Stock Trading and Cryptocurrency

While not suitable for everyone, stock trading and cryptocurrency trading can be a way to earn money online fast. However, these are high-risk activities, and it's important to do thorough research and understand the risks involved. Start with a small amount of capital and consider using a demo account to practice before investing real money. Remember, while there are legitimate ways to earn money online fast, it's important to be cautious and avoid scams. Always research any opportunity thoroughly and be wary of promises that sound too good to be true. With dedication and the right approach, you can start earning money online quickly and build a sustainable income.

how to earn money online

How to Earn Money Online In today's digital age, earning money online has become more accessible than ever before. With the rise of the internet, there are numerous opportunities for individuals to generate income from the comfort of their own homes. Whether you are looking to supplement your regular income or quit your job and become a full-time digital entrepreneur, this article will provide you with some practical tips and ideas to help you earn money online.

Choose a Niche

One of the first steps to earning money online is to identify a niche that you are passionate about. A niche is a specific area or market that you want to focus on. By specializing in a particular niche, you can become an authority in that field and attract a loyal audience. For example, you could choose to write about travel, finance, technology, or health and fitness. Remember to select a niche that has a large enough audience to support your business.

Once you have identified your niche, the next step is to create valuable content. Content can take various forms, such as blog posts, videos, podcasts, or infographics. The key is to provide informative, engaging, and high-quality content that adds value to your audience. By doing so, you can establish yourself as an expert in your niche and build trust with your followers.

Monetize Your Content

There are several ways to monetize your content and generate income. Here are some popular monetization methods:

1. Affiliate Marketing: This involves promoting other people's products or services and earning a commission for each sale made through your referral. To get started with affiliate marketing, choose a product or service that complements your niche and create content that promotes it.

2. Display Advertising: You can monetize your website or blog by displaying ads from companies like Google AdSense. When visitors click on these ads or engage with them in other ways, you earn money.

3. Selling Your Own Products: If you have a unique product or service to offer, you can create a website or online store to sell it directly to customers. This could be anything from handmade crafts to digital products like e-books or courses.

4. Offer Consulting Services: If you have expertise in a particular area, you can offer consulting services online. This could involve helping businesses with marketing strategies, website development, or social media management.

Build an Email List

An email list is a valuable asset for any online business. By collecting the email addresses of your followers, you can send them exclusive offers, updates, and promotions. An effective email marketing strategy can help you generate a significant portion of your income.

To build your email list, offer a freebie or a discount in exchange for subscribers. You can use opt-in forms on your website or create lead magnets such as e-books, checklists, or webinars.

Utilize Social Media

Social media platforms like Facebook, Instagram, Twitter, and LinkedIn can be powerful tools for promoting your content and attracting new followers. By sharing valuable content and engaging with your audience, you can drive traffic to your website and increase your income.

Remember to be consistent with your social media presence and create content that resonates with your audience. The more active you are on social media, the more likely you are to grow your following and generate income.

In conclusion, earning money online requires dedication, patience, and a willingness to learn. By choosing a niche, creating valuable content, and implementing effective monetization strategies, you can turn your passion into a profitable online business. Remember to stay updated with the latest trends and adapt your strategy as needed to achieve your goals.

ways to earn money online

In today's digital age, the internet has opened up numerous opportunities for people to earn money from the comfort of their homes. Whether you are looking for a part-time job, a full-time career, or just a way to make some extra cash, there are countless ways to earn money online. Here are some of the most popular and effective methods:

Freelancing

Freelancing has become one of the most popular ways to earn money online. Platforms like Upwork, Freelancer, and Fiverr allow you to offer your skills and services to clients from all over the world. Whether you are a writer, graphic designer, programmer, or translator, there is a high demand for your skills.

One of the benefits of freelancing is the flexibility it offers. You can choose your own hours, work on projects that interest you, and set your own rates. However, it is important to be disciplined and manage your time effectively to ensure that you meet your deadlines and deliver high-quality work.

Online Surveys and Market Research

Another way to earn money online is by participating in online surveys and market research. Websites like Swagbucks, Survey Junkie, and Vindale Research pay you for completing surveys, watching videos, and participating in other market research activities.

While the pay for these activities is usually not very high, it can be a good way to make some extra cash in your spare time. Additionally, some of these websites offer rewards points that you can redeem for gift cards or cash.

Dropshipping

Dropshipping is a business model that allows you to sell products online without having to hold inventory. You create an online store, and when a customer buys a product, the supplier ships it directly to the customer on your behalf.

Dropshipping can be a lucrative business model, but it requires some effort to set up and manage your online store. You will need to research and choose the right products, create compelling product listings, and market your store to attract customers.

Online Courses and E-books

If you have expertise in a particular subject, you can create and sell online courses or e-books. Platforms like Udemy, Teachable, and Amazon Kindle Direct Publishing allow you to share your knowledge with others and earn money from it.

Creating online courses or e-books can be a time-consuming process, but it can also be a highly rewarding one. Once your course or e-book is created, you can continue to earn money from it for years to come.

Affiliate Marketing

Affiliate marketing is a way to earn money by promoting products or services online. You create content, such as blog posts or social media posts, that includes links to products or services. When someone clicks on the link and makes a purchase, you earn a commission.

Affiliate marketing requires some knowledge of digital marketing and SEO, but it can be a highly effective way to earn money online. You can choose to promote products or services in any niche that interests you, and you can work with multiple affiliate programs to maximize your earnings.

In conclusion, there are many ways to earn money online, and the best method for you will depend on your skills, interests, and goals. Whether you choose to freelance, participate in online surveys, start a dropshipping business, create online courses or e-books, or become an affiliate marketer, there are countless opportunities to make money from the comfort of your home. With some effort and dedication, you can turn your online earnings into a sustainable income.

earn money online

Introduction

In today's digital age, the internet has opened up a world of opportunities for individuals to earn money from the comfort of their own homes. With the rise of online platforms and remote work, earning money online has become a viable and attractive option for many. Whether you're looking to supplement your income or transition to a full-time online career, there are numerous ways to make money online. In this article, we will explore some of the most popular methods to earn money online.

One of the most popular ways to earn money online is through freelancing. Websites like Upwork, Freelancer, and Fiverr connect freelancers with clients from all over the world. Whether you have skills in writing, graphic design, programming, or any other field, you can offer your services and get paid for your work. The beauty of freelancing is that you can set your own hours and work on projects that interest you.

Online Surveys and Market Research

Another way to earn money online is by participating in online surveys and market research studies. Websites like Swagbucks, Survey Junkie, and Vindale Research offer users the chance to complete surveys and provide feedback on products and services. While the pay per survey may not be substantial, it can add up over time, and it's a great way to earn some extra cash in your spare time.

Online Shopping and Cashback Programs

Online shopping is a daily activity for many, and it can also be a way to earn money. Websites like Rakuten, Ibotta, and Honey offer cashback and discount codes for online purchases. By using these services, you can get a percentage of your purchase back or receive discounts on items you were already planning to buy. It's a win-win situation where you save money and earn cashback at the same time.

Dropshipping and E-commerce

For those interested in starting an online business, dropshipping and e-commerce are excellent options. Dropshipping allows you to sell products online without having to handle inventory or shipping. You can set up an online store, market products, and fulfill orders without the need for a physical product. E-commerce platforms like Shopify and WooCommerce make it easy to create and manage an online store. With the right products and marketing strategies, you can earn a significant income from e-commerce.

Content Creation and Affiliate Marketing

Content creation is a growing industry, and it offers numerous opportunities to earn money online. Whether you create videos, write blogs, or design podcasts, you can monetize your content through advertising, sponsorships, and affiliate marketing. Affiliate marketing involves promoting products or services and earning a commission for each sale or referral. Websites like Amazon Associates and ClickBank provide a platform to connect with potential customers and earn commissions.

Teaching and Tutoring Online

If you have expertise in a particular subject, you can earn money by teaching or tutoring online. Platforms like VIPKid, Chegg Tutors, and iTalki allow you to teach students from around the world. You can set your own rates and work flexible hours, making it a great option for those who enjoy sharing their knowledge and helping others learn.

Conclusion

Earning money online is not just a trend; it's a sustainable way to make a living. With the right skills, tools, and mindset, anyone can start earning money online. Whether you choose to freelance, participate in surveys, sell products online, create content, or teach, the internet offers a plethora of opportunities. It's important to research and choose a method that aligns with your skills and interests. With dedication and perseverance, you can turn your online endeavors into a profitable venture.

usdt wallet

The Importance of a USDT Wallet In the rapidly evolving world of cryptocurrencies, having a reliable and secure wallet is crucial for managing your digital assets. One such digital currency that has gained significant popularity is Tether (USDT), a stablecoin pegged to the US dollar. A USDT wallet is essential for storing, sending, and receiving USDT, ensuring that your investments remain safe and accessible. In this article, we will discuss the importance of a USDT wallet and the various types available.

Why Use a USDT Wallet?

A USDT wallet is essential for several reasons: 1. **Security**: Storing your USDT in a wallet provides a secure and private way to manage your digital assets. Unlike exchanges, wallets are not vulnerable to hacking and other security breaches. 2. **Accessibility**: With a USDT wallet, you can access your funds from anywhere in the world, as long as you have an internet connection. 3. **Control**: A USDT wallet gives you full control over your assets, allowing you to make transactions without relying on third-party services. 4. **Privacy**: Unlike traditional banking systems, using a USDT wallet can offer a higher level of privacy, as you do not need to share your personal information with anyone.

Types of USDT Wallets

There are several types of USDT wallets available, each with its own set of features and benefits: 1. **Mobile Wallets**: These wallets are available as apps on your smartphone and are convenient for everyday transactions. Examples include Trust Wallet and Atomic Wallet. 2. **Desktop Wallets**: Desktop wallets are installed on your computer and offer more advanced features, such as cold storage options. Examples include Ledger Nano S and Exodus. 3. **Hardware Wallets**: Hardware wallets are physical devices designed to store your private keys offline, providing the highest level of security. Examples include Ledger Nano X and Trezor Model T. 4. **Web Wallets**: Web wallets are online services that allow you to access your USDT from any device with an internet connection. Examples include Tether.to and BitPay. 5. **Paper Wallets**: Paper wallets are printed documents containing your private and public keys. While they offer high security, they can be easily damaged or lost.

Best Practices for Using a USDT Wallet

To ensure the safety and security of your USDT, follow these best practices: 1. **Backup Your Wallet**: Regularly backup your wallet to prevent data loss. For hardware wallets, use the backup feature provided by the manufacturer. 2. **Use Strong Passwords**: Set a strong and unique password for your wallet to prevent unauthorized access. 3. **Keep Your Private Key Private**: Never share your private key with anyone, as it gives them full control over your USDT. 4. **Update Your Wallet**: Keep your wallet software up to date to ensure you have the latest security features and bug fixes. 5. **Be Wary of Phishing**: Be cautious of phishing attempts, as cybercriminals may try to steal your private key or login credentials. In conclusion, a USDT wallet is an essential tool for managing your Tether assets. By choosing the right wallet and following best practices, you can ensure the security and accessibility of your digital assets. Remember, the key to a successful USDT wallet experience lies in responsible management and staying informed about the latest developments in the cryptocurrency space.

usdt trc20

The Evolution of USDT TRC20: A Comprehensive Guide

In the rapidly evolving world of cryptocurrencies, the USDT TRC20 token has emerged as a significant player. This guide aims to provide an in-depth understanding of USDT TRC20, its features, benefits, and its role in the cryptocurrency ecosystem.

【USDT TRC20】 was launched in February 2020, becoming the first stablecoin to be issued on the Tron blockchain. This marked a significant milestone for the Tron network, as it showcased its capability to handle large-scale transactions efficiently. Unlike other stablecoins that rely on different blockchains, USDT TRC20 operates on the Tron network, offering users a seamless and cost-effective experience.

Understanding USDT TRC20

USDT TRC20 is a type of stablecoin that is backed by the US dollar. One USDT is equivalent to one US dollar, ensuring stability in its value. This stability is crucial for investors and traders looking to mitigate the volatility associated with traditional cryptocurrencies. Unlike Bitcoin or Ethereum, which are subject to price fluctuations, USDT TRC20 offers a stable and reliable value.

One of the key features of USDT TRC20 is its rapid transaction speed. Thanks to the Tron blockchain's high throughput capacity, transactions are confirmed within seconds, making it an ideal choice for users who require quick and efficient transfers. This feature has made USDT TRC20 a preferred choice for cross-border payments and micropayments.

Benefits of USDT TRC20

There are several benefits associated with using USDT TRC20:

Stability: As a US dollar-backed stablecoin, USDT TRC20 ensures stability in its value, making it a reliable investment and transaction medium.

Speed: Transactions are confirmed within seconds, offering users a seamless and efficient experience.

Accessibility: USDT TRC20 can be used on any device with internet access, making it easily accessible to a wide user base.

Low transaction fees: Compared to traditional banking systems, USDT TRC20 offers lower transaction fees, especially for cross-border payments.

The Role of USDT TRC20 in the Cryptocurrency Ecosystem

USDT TRC20 has played a significant role in the cryptocurrency ecosystem, contributing to its growth and adoption. Some key aspects include:

Facilitating Cross-Border Payments: USDT TRC20 has become a popular choice for cross-border payments, offering users a cost-effective and efficient alternative to traditional banking systems.

Boosting Trading Activities: With its stable value and fast transaction speed, USDT TRC20 has become a preferred choice for traders looking to mitigate the risks associated with price volatility.

Enhancing the Tron Ecosystem: By introducing USDT TRC20, the Tron network has gained a significant user base, further enhancing its position in the cryptocurrency market.

In conclusion, USDT TRC20 has revolutionized the way transactions are conducted in the cryptocurrency ecosystem. With its stability, speed, and low transaction fees, it has become a go-to choice for users seeking a reliable and efficient means of transferring value.

eth to usdt

Introduction

As the cryptocurrency market continues to evolve, Ethereum (ETH) and Tether (USDT) have emerged as two of the most popular digital assets. ETH is the native cryptocurrency of the Ethereum network, known for its smart contract capabilities, while USDT is a stablecoin designed to maintain a stable value against the US dollar. The exchange rate between ETH and USDT has been a topic of interest for many investors and traders. In this article, we will explore the factors that influence the ETH to USDT exchange rate and discuss the best practices for exchanging these assets.

Understanding Ethereum (ETH)

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). Launched in 2015, ETH has gained significant traction in the cryptocurrency space due to its versatility and widespread adoption. As the second-largest cryptocurrency by market capitalization, ETH has a strong community and robust infrastructure. The value of ETH is determined by supply and demand dynamics in the market, influenced by various factors such as network activity, technological advancements, and regulatory news.

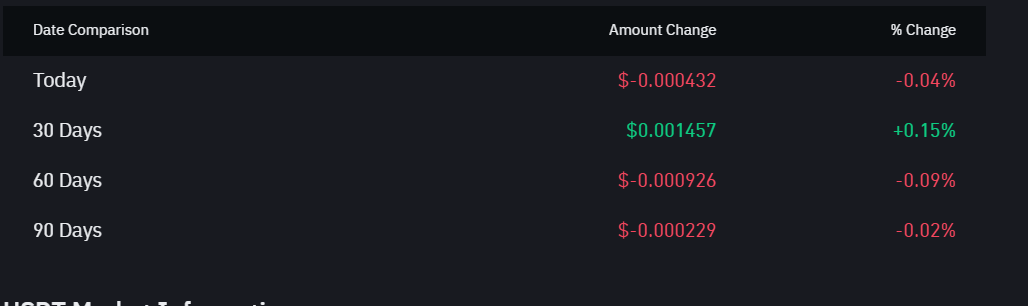

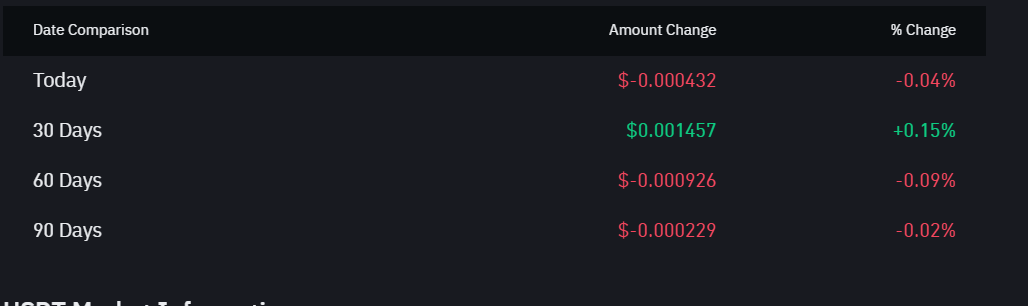

Understanding Tether (USDT)

Tether is a stablecoin that aims to maintain a stable value of $1 by backing each USDT token with one US dollar in reserves. Launched in 2014, USDT has become the most widely used stablecoin in the cryptocurrency market. Its peg to the US dollar makes it an attractive asset for investors looking to mitigate the volatility of other cryptocurrencies. Tether's primary use cases include facilitating transactions, acting as a medium of exchange, and providing a bridge between fiat currencies and the crypto market.

Factors Influencing ETH to USDT Exchange Rate

The exchange rate between ETH and USDT is influenced by several factors:

Market demand and supply: The value of ETH is influenced by the number of ETH in circulation and the demand for Ethereum-based products and services. Similarly, the demand for USDT affects its exchange rate.

Network activity: Ethereum's network activity, such as transaction volume and gas fees, can impact the value of ETH. An increase in network activity often leads to a higher ETH price.

Regulatory news: Changes in regulatory policies regarding cryptocurrencies can significantly affect the market sentiment and, consequently, the ETH to USDT exchange rate.

Technological advancements: Ethereum's ongoing development, such as upgrades and improvements to its blockchain, can influence the demand for ETH and its exchange rate.

Best Practices for Exchanging ETH to USDT

When exchanging ETH to USDT, it is crucial to consider the following best practices:

Choose a reliable exchange: Opt for a reputable cryptocurrency exchange with a good track record in security and customer service.

Understand the fees: Be aware of any fees associated with the exchange, including transaction fees and withdrawal fees.

Stay informed: Keep up with market trends and news to make informed decisions about your investments.

Use secure wallets: Store your USDT in a secure wallet to protect your assets from theft and loss.

Conclusion

Exchanging ETH to USDT can be a lucrative investment strategy for those looking to diversify their cryptocurrency portfolio. By understanding the factors that influence the ETH to USDT exchange rate and following best practices for exchanging these assets, investors can make more informed decisions and potentially maximize their returns. Keep in mind that the cryptocurrency market is highly volatile, and it is essential to stay updated on market trends and news.

【eth to usdt】

btc to usdt

## The Transition from BTC to USDT: Understanding the Shift in Cryptocurrency Exchange In the rapidly evolving world of cryptocurrencies, the transition from Bitcoin (BTC) to Tether (USDT) has become a topic of great interest. This article aims to delve into the reasons behind this shift and explore the implications it has for the cryptocurrency market. ### Why the Shift? One of the primary reasons for the shift from BTC to USDT is the stability offered by the latter. While Bitcoin has seen significant price volatility, USDT has maintained a stable value of $1. This has made it an attractive option for traders and investors looking to avoid the risks associated with BTC's price fluctuations. Moreover, USDT is backed by fiat currency, which adds an extra layer of security and trust. This contrasts with Bitcoin, which is decentralized and operates independently of any government or financial institution. For many users, the ability to convert BTC to USDT and back again provides a sense of security and stability that is not available with Bitcoin alone. ### Benefits of Using USDT

One of the key benefits of using USDT is its wide acceptance in the cryptocurrency market. Many exchanges and platforms support USDT, making it easy for users to trade and invest in various cryptocurrencies. This has led to a significant increase in the adoption of USDT, as more and more users look to take advantage of its stability and convenience.

Additionally, USDT is often used as a medium of exchange. Since it is backed by fiat currency, it can be easily converted to other currencies, making it a popular choice for international transactions. This has been particularly beneficial for businesses and individuals who need to make cross-border payments.

How to Convert BTC to USDT

Converting BTC to USDT is a straightforward process. Most cryptocurrency exchanges offer a simple interface for users to make the conversion. Here's a general guide on how to do it: 1. Sign up and log in to your chosen cryptocurrency exchange. 2. Navigate to the trading section and select the BTC to USDT pair. 3. Enter the amount of BTC you wish to convert and confirm the transaction. 4. Once the conversion is complete, the USDT will be credited to your exchange wallet. ### Risks and Considerations While USDT offers stability and convenience, it is important to be aware of the risks involved. The most significant risk is the potential for loss of funds if the exchange holding your USDT is hacked or faces other security issues. Additionally, the regulatory environment surrounding cryptocurrencies is still evolving, which could impact the use of USDT and other stablecoins. In conclusion, the shift from BTC to USDT reflects the changing needs of the cryptocurrency market. As more users seek stability and convenience, USDT has become an increasingly popular option. However, it is important to stay informed about the risks and to choose a reputable exchange for your conversions.

bitcoin price to usdt

Bitcoin Price to USDT: The Current Market Dynamics and Future Projections The cryptocurrency market has been a buzz in recent years, with Bitcoin leading the pack as the most popular digital currency. Bitcoin's price has been fluctuating constantly, and it's crucial to understand the dynamics behind these changes. One of the key aspects to consider is the Bitcoin price to USDT, which represents the exchange rate between Bitcoin and the stablecoin Tether (USDT). In this article, we will delve into the current market dynamics and future projections for the Bitcoin price to USDT.

Understanding Bitcoin Price to USDT

Bitcoin (BTC) is a decentralized digital currency, and its value is determined by the supply and demand in the market. Tether (USDT), on the other hand, is a stablecoin that aims to maintain a value of $1 by being backed by fiat currencies or other assets. The Bitcoin price to USDT is the ratio of the current value of Bitcoin to the value of one USDT.

Over the years, Bitcoin has seen massive growth, with its price skyrocketing from a few cents to thousands of dollars. The correlation between Bitcoin and USDT has been a topic of interest for many investors and traders, as it plays a significant role in the cryptocurrency market.

Current Market Dynamics

The current Bitcoin price to USDT is influenced by several factors, including market sentiment, regulatory news, and global economic conditions. Here are some of the key factors affecting the Bitcoin price to USDT:

1. Market Sentiment: The cryptocurrency market is highly speculative, and market sentiment plays a crucial role in determining the value of Bitcoin. Positive news, such as increased adoption by institutional investors, can drive up the price, while negative news can lead to a decline.

2. Regulatory News: Governments and regulatory bodies worldwide are still trying to figure out how to regulate the cryptocurrency market. Any regulatory news, whether positive or negative, can significantly impact the Bitcoin price to USDT.

3. Global Economic Conditions: The global economy's performance, such as inflation rates, GDP growth, and central bank policies, can also influence the Bitcoin price to USDT. In times of economic uncertainty, Bitcoin is often seen as a safe haven, leading to an increase in its value.

Future Projections

Predicting the future of the Bitcoin price to USDT is challenging, but here are some potential scenarios:

1. Continued Growth: As Bitcoin gains wider adoption, its value could continue to rise. Some analysts predict that Bitcoin could reach $100,000 or even higher in the long term.

2. Volatility: The cryptocurrency market is known for its volatility, and Bitcoin is no exception. The price could experience significant fluctuations, making it a high-risk investment for some.

3. Regulatory Changes: If governments worldwide implement strict regulations on cryptocurrencies, it could lead to a decline in Bitcoin's value. However, some experts believe that regulation could also pave the way for long-term growth. In conclusion, the Bitcoin price to USDT is a critical metric to understand the current market dynamics and future projections. As Bitcoin continues to gain traction, investors and traders must stay informed about the factors that drive its value and be prepared for potential volatility. With the right strategy and risk management, Bitcoin could be a valuable asset for those willing to invest in the digital currency market.

usdt meaning

USDT, which stands for Tether, is a cryptocurrency that has gained significant popularity in the world of digital finance. Its purpose and implications are multifaceted, making it a subject of great interest for investors, traders, and enthusiasts alike. In this article, we will delve into the meaning of USDT and its significance in the cryptocurrency ecosystem.

Understanding the Basics of USDT

USDT is a type of stablecoin, a cryptocurrency designed to minimize price volatility. Unlike other cryptocurrencies like Bitcoin or Ethereum, which can experience wild fluctuations in value, USDT aims to maintain a stable value by being backed by fiat currency, primarily the US dollar. Each USDT is equivalent to one US dollar, making it a reliable medium of exchange in the volatile world of cryptocurrencies.

How USDT Works

USDT operates on the Omni Layer protocol, which is a second-layer protocol built on top of the Bitcoin network. This means that USDT can be transacted on the Bitcoin blockchain, offering users the benefits of blockchain technology while ensuring stability. When a user wants to purchase USDT, they can either exchange their Bitcoin for USDT or purchase it directly with fiat currency from a Tether exchange.

The Significance of USDT

One of the primary reasons USDT has gained such popularity is its ability to provide a stable value in the cryptocurrency market. This makes it an ideal asset for traders and investors looking to avoid the risks associated with volatile cryptocurrencies. Additionally, USDT serves as a reliable medium of exchange, allowing users to send and receive funds quickly and easily across various platforms and exchanges.

USDT and the Crypto Ecosystem

USDT plays a crucial role in the cryptocurrency ecosystem by facilitating cross-border transactions and acting as a bridge between fiat currency and cryptocurrencies. Its stable value makes it an attractive option for users who want to avoid the risks associated with fiat currency exchanges, while still being able to take advantage of the benefits of blockchain technology.

USDT and Regulatory Compliance

One of the concerns surrounding stablecoins, including USDT, is their regulatory compliance. Tether has faced scrutiny from regulators and the public over the years regarding its transparency and the extent to which it is backed by fiat currency. Despite these concerns, USDT continues to be widely used, highlighting its importance in the cryptocurrency ecosystem.

Conclusion

In conclusion, USDT, or Tether, is a stablecoin that serves as a reliable medium of exchange and a stable asset in the volatile world of cryptocurrencies. Its significance lies in its ability to provide stability, facilitate cross-border transactions, and bridge the gap between fiat currency and digital assets. As the cryptocurrency market continues to evolve, USDT's role as a stablecoin is likely to remain crucial in shaping the future of digital finance.

pnut usdt

PNut USDT: Revolutionizing Cryptocurrency Exchange with Speed and Convenience In the rapidly evolving world of cryptocurrencies, PNut USDT stands out as a leading platform that offers unparalleled speed and convenience. With its innovative features and user-friendly interface, PNut USDT has become the go-to choice for many cryptocurrency enthusiasts and investors. This article delves into the key aspects of PNut USDT, highlighting its unique offerings and the benefits it brings to the crypto community.

What is PNut USDT?

PNut USDT is a cryptocurrency exchange platform that focuses on providing fast and secure transactions using Tether (USDT), a stablecoin that is backed by the US dollar. The platform is designed to cater to the needs of both beginners and experienced traders, offering a seamless experience for everyone.

One of the standout features of PNut USDT is its lightning-fast transaction speeds. Traditional exchanges can be plagued by delays and high fees, but PNut USDT has managed to overcome these challenges. By utilizing the Tether network, transactions are processed almost instantly, allowing users to execute trades quickly and efficiently.

Key Features of PNut USDT

1.

Low Transaction Fees: PNut USDT offers some of the lowest transaction fees in the industry. This means that users can save a significant amount of money on each trade, making it an attractive option for those looking to maximize their profits.

2.

Stablecoin Support: PNut USDT supports Tether (USDT), a stablecoin that is pegged to the US dollar. This feature provides users with a reliable and stable currency to trade and store their assets, reducing the volatility often associated with cryptocurrencies.

3.

User-Friendly Interface: The platform is designed with a user-friendly interface, making it easy for both beginners and experienced traders to navigate. The intuitive layout and simple design ensure that users can quickly find what they need and execute their trades without any hassle.

4.